Tracking Capex in the Haynesville

Trends and Drivers in the Basin

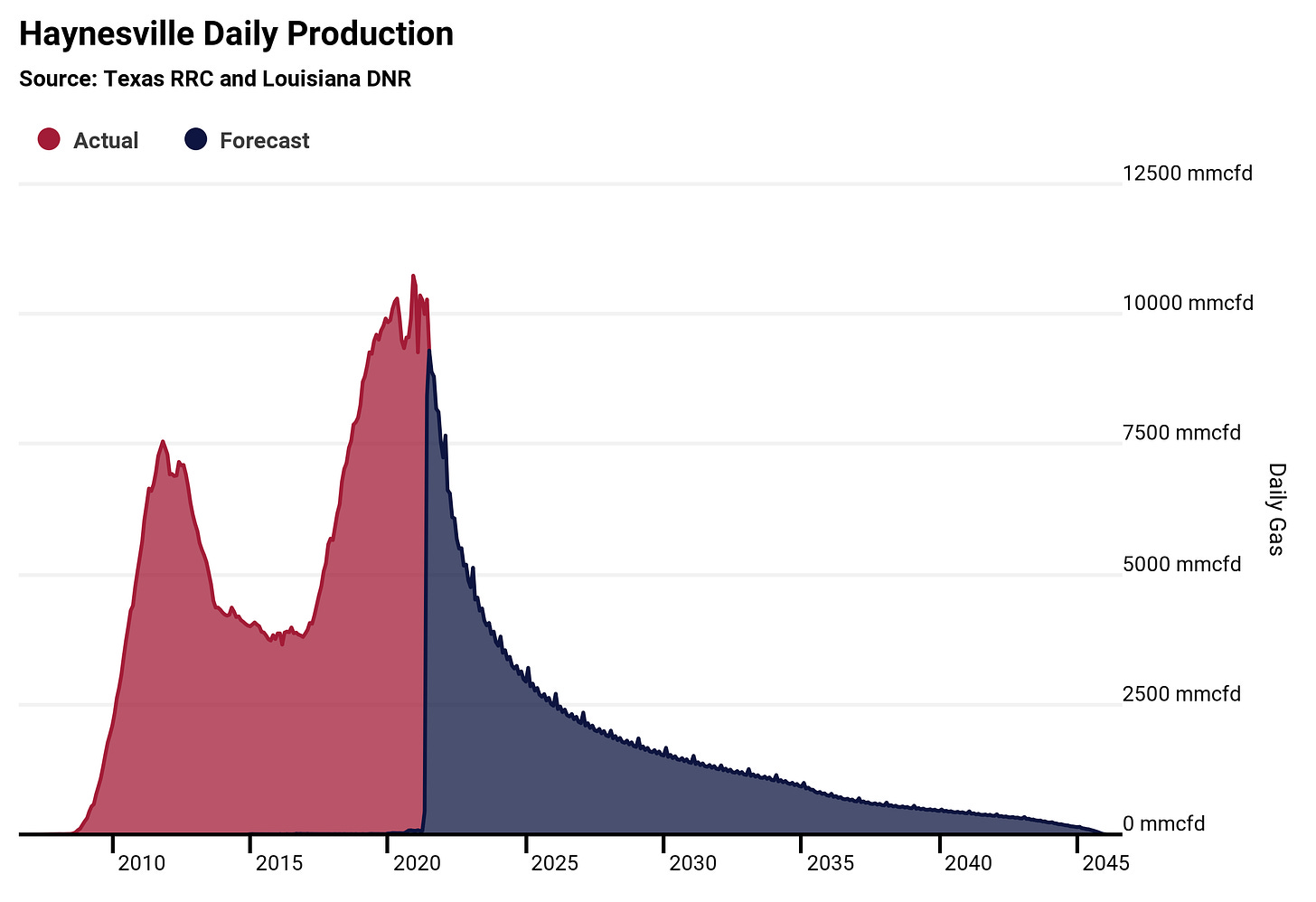

After being left for dead in 2011 when gas prices crashed, the Haynesville staged quite the rebound post-2016 as costs came down and operators started using newer generation completion designs.

In this insight, I’ll dig deeper into overall capex trends in the basin, as well as the various cost drivers too.

Capex Trends

As some background, through a bit of …

Keep reading with a 7-day free trial

Subscribe to shaleInsights.blog to keep reading this post and get 7 days of free access to the full post archives.